by Peter Schiff, Schiff Gold:

After running a $1.3 trillion deficit in fiscal 2022, the US government took up right where it left off to start fiscal 2023 — running a big budget deficit.

The October budget deficit came in at $87.8 billion despite another month of healthy government receipts, according to the latest Treasury statement.

The federal government collected $318.58 billion in October. That was a 12.2% increase in revenue over last October.

TRUTH LIVES on at https://sgtreport.tv/

Strong government revenues in October continued a trend we saw during the last fiscal year. Uncle Sam was flush with cash in 2022. The Treasury took in $4.9 trillion. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21% in the 2022 fiscal year that ended on Sept. 30. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP.

So, the federal government’s problem isn’t a lack of money. It is a spending problem.

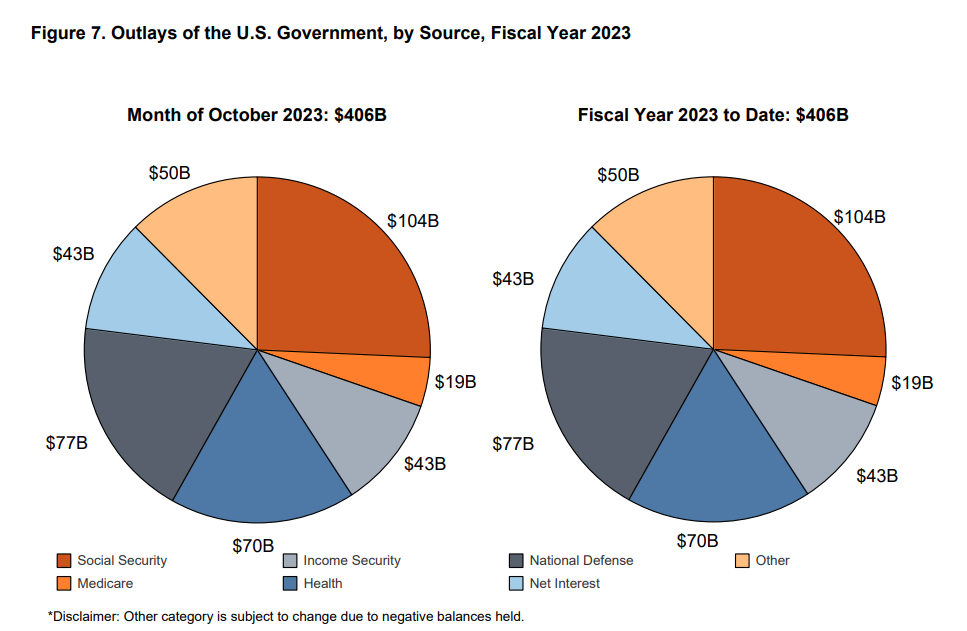

The Biden administration blew through $406.37 billion in October.

Spending this past October was just slightly lower than last year, but there is more spending coming down the pike.

The US government is still handing out COVID stimulus and it wants more. Congress recently pushed through another massive spending bill. Meanwhile, the US continues to shower money on Ukraine and other countries around the world. And we’re just starting to see the impact of student loan forgiveness.

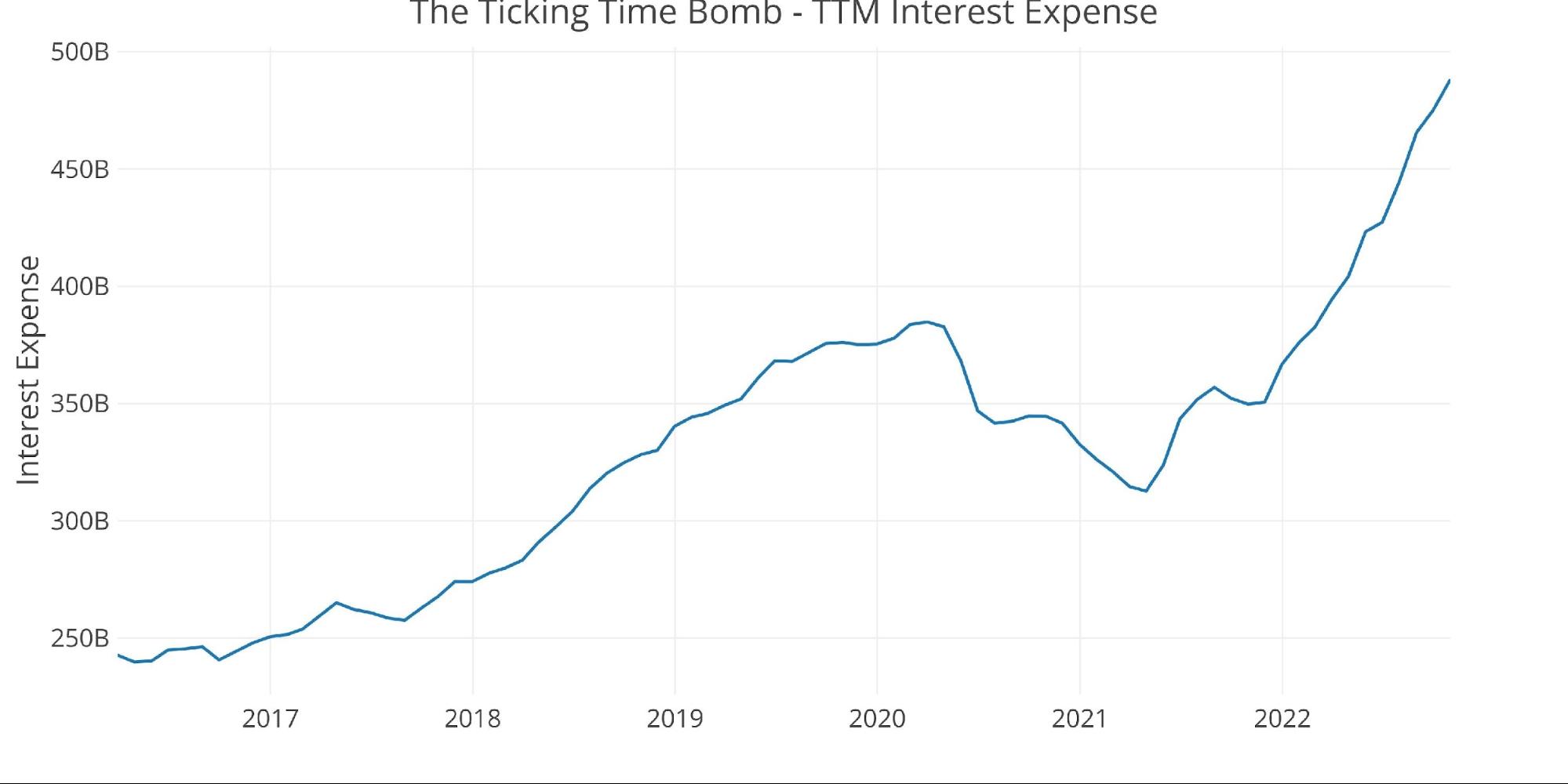

On top of increased spending, rising interest rates will push the deficits up even more. Interest expenses increased $12 billion month-on-month and were up 40% compared to just one year ago.

According to the Congressional Budget Office, interest expense is about to balloon. It projects interest payments will triple from nearly $400 billion in fiscal 2022 to $1.2 trillion in 2032. And it’s worse than that. The CBO made this estimate in May. Interest rates are already higher than those used in its analysis.

If interest rates remain elevated or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

Last month, the national debt blew past $31 trillion. It now stands at $31.24 trillion.

According to the National Debt Clock, the debt-to-GDP ratio is 121.51%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt-to-GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $93,819 in order to pay off the national debt.

A Big Problem for the Fed

The soaring national debt and the US government’s spending addiction are big problems for the Federal Reserve as it battles inflation.

In a recent podcast, Peter Schiff pointed out that tackling inflation requires a two-pronged attack. It needs positive real interest rates and cuts in government spending. Peter said the spending cuts will never happen.

In fact, government spending is going to continue to increase, and so will the deficits that are making that spending possible.”

This creates two conundrums for the Fed.

In the first place, raising interest rates makes it more and more expensive for the US government to borrow money. I discussed the implications of rising interest costs above.

In the second place, the US government can’t keep borrowing and spending without the Fed monetizing the debt. It needs the central bank to buy Treasuries to prop up demand. Without the Fed’s intervention in the bond market, prices will tank, driving interest rates on US debt even higher.

A paper published by the Kansas City Federal Reserve Bank acknowledged that the central bank can’t slay inflation unless the US government gets its spending under control. In a nutshell, the authors argue that the Fed can’t control inflation alone. US government fiscal policy contributes to inflationary pressure and makes it impossible for the Fed to do its job.

Trend inflation is fully controlled by the monetary authority only when public debt can be successfully stabilized by credible future fiscal plans. When the fiscal authority is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure sustainability of national debt. As a result, a large fiscal imbalance combined with a weakening fiscal credibility may lead trend inflation to drift away from the long-run target chosen by the monetary authority.”

This clearly isn’t in the cards.

Something has to give. The Fed can’t simultaneously fight inflation and prop up Uncle Sam’s spending spree. Either the government will have to cut spending or the Fed will have to keep creating money out of thin air in order to monetize the debt. You can decide for yourself which scenario you find more likely.