by Peter Schiff, Schiff Gold:

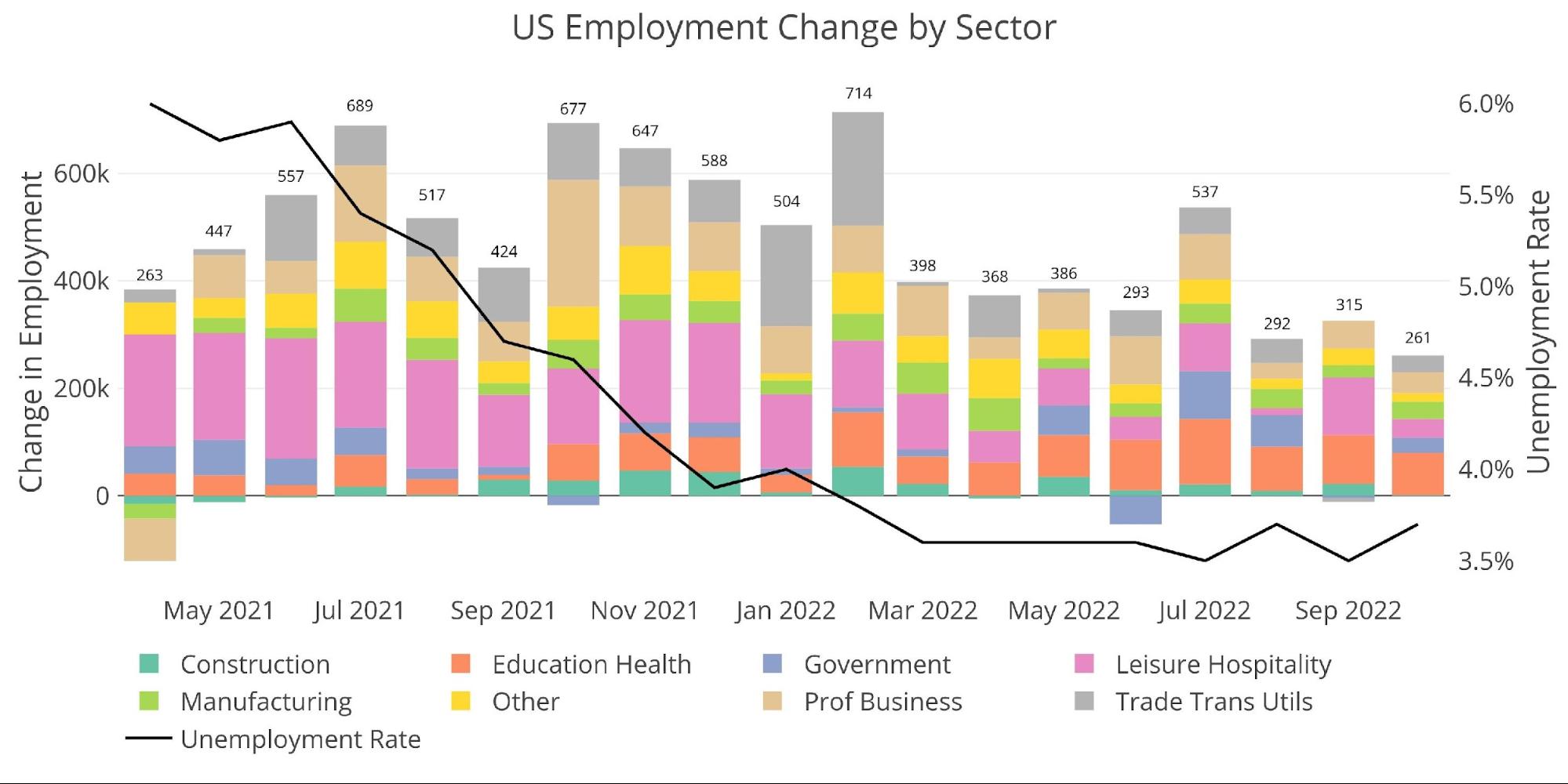

According to the BLS, the economy added 261k jobs in October with a big revision up in September from 263k to 315k. October was a beat against median expectations of 205k. The employment rate (black line) increased from 3.5% to 3.7% while the labor force participation ticked down from 62.3% to 62.2%.

The job numbers have stayed surprisingly resilient despite daily announcements by major companies of job cuts and freezes. It’s only a matter of time before this feeds into the BLS job numbers.

TRUTH LIVES on at https://sgtreport.tv/

Figure: 1 Change by sector

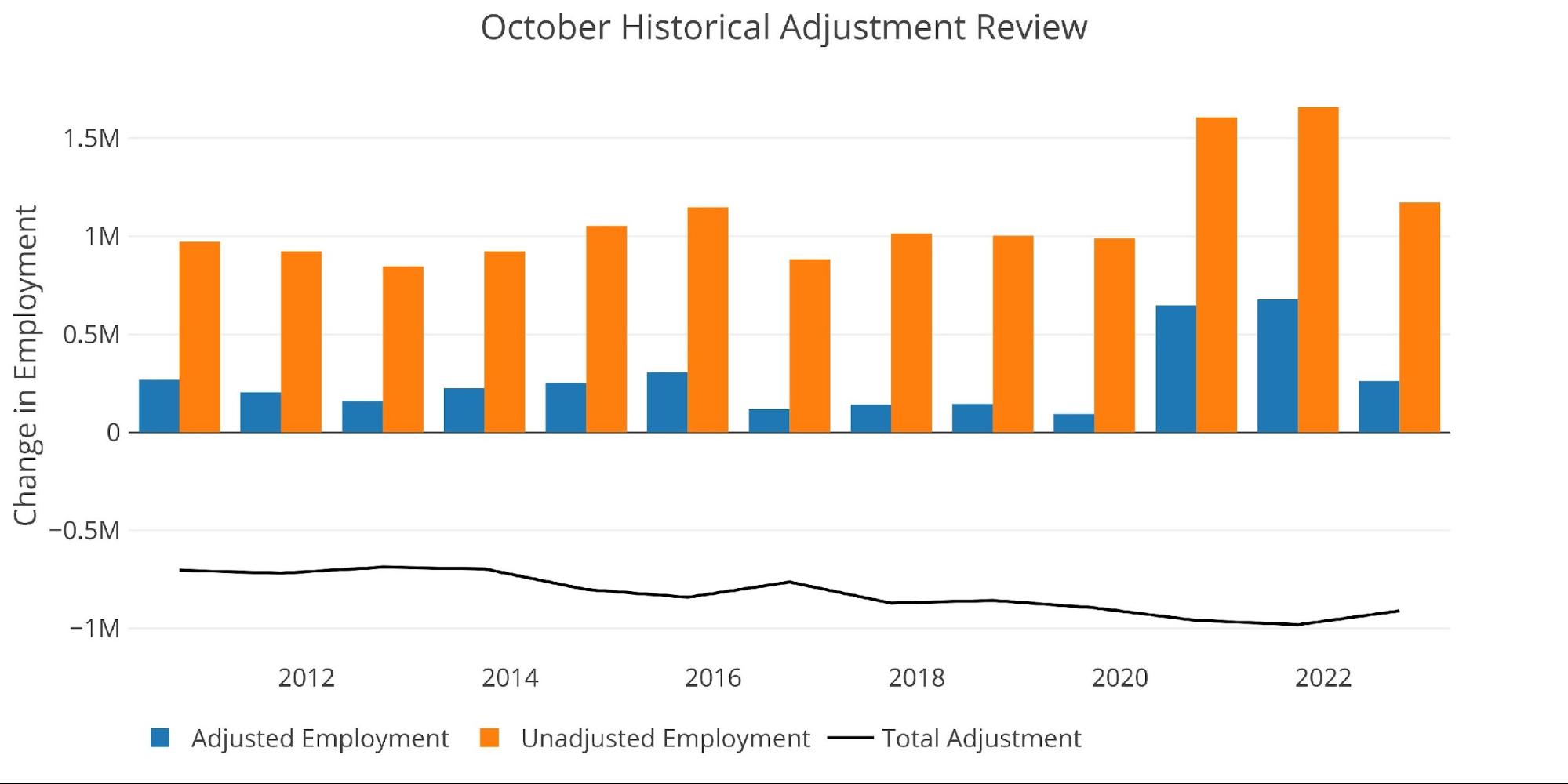

When looking at the unadjusted numbers, October is the strongest month since February. It is down YoY when compared to last October when 1.66M jobs were added.

Figure: 2 Monthly Non-Seasonally Adjusted

October is historically a month that sees major downward seasonal adjustments. Adjustments have ranged from 700k-1M jobs since 2010. The latest October saw an adjustment down of 911k jobs. This is most likely a result of seasonal hiring in anticipation of the holiday season. The adjustment down will smooth out the data across months.

Figure: 3 YoY Adjusted vs Non-Adjusted

Breaking Down the Adjusted Numbers

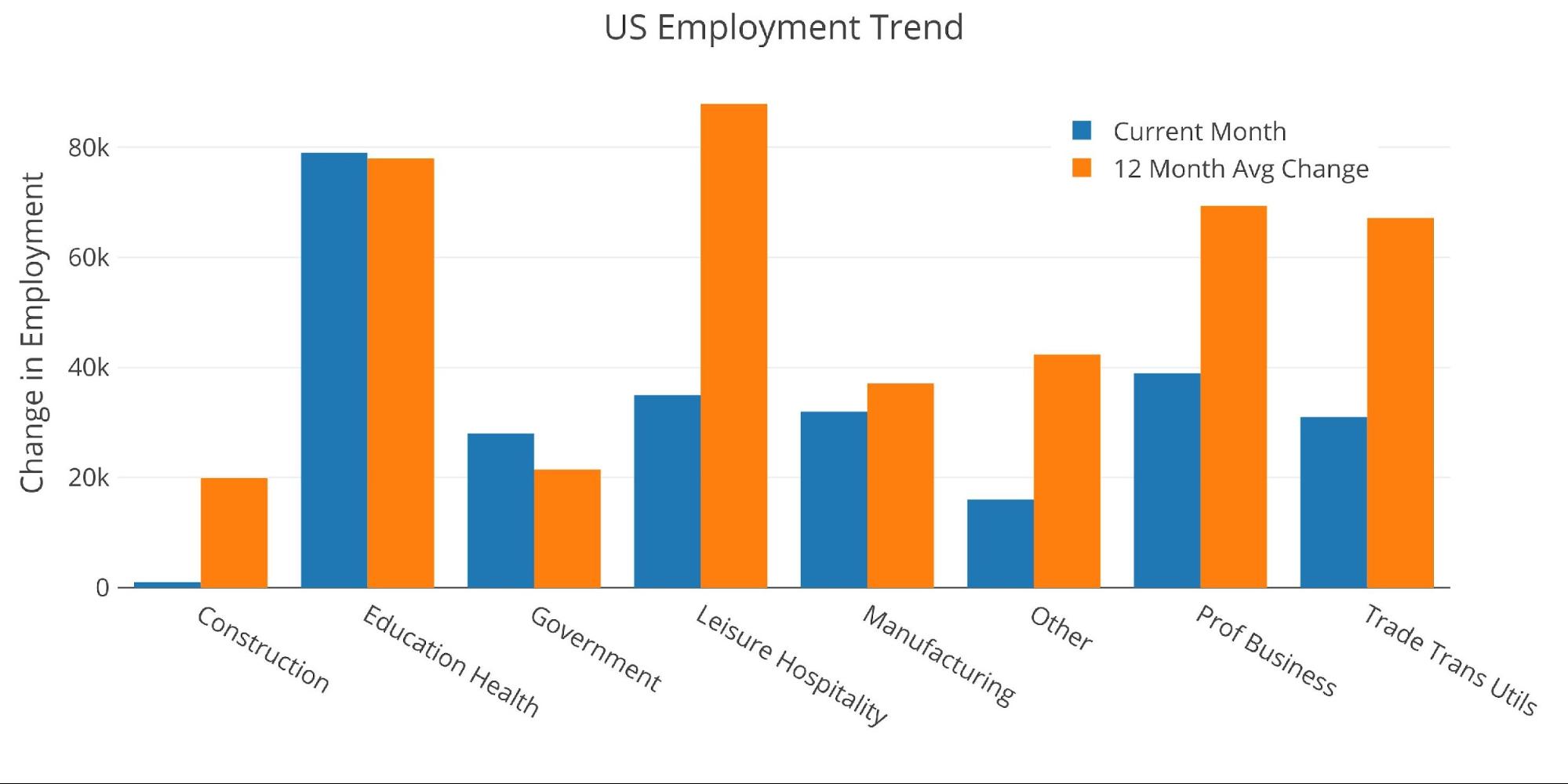

Despite the better-than-expected number, the job market continues to slow. This can be seen in the chart below where every sector is below the 12-month trend except for Government and Education/Health. Construction is anemic, while Leisure/Hospitality, Other, and Trade Transport Utils are all 50% below their 12-month trend.

Figure: 4 Current vs TTM

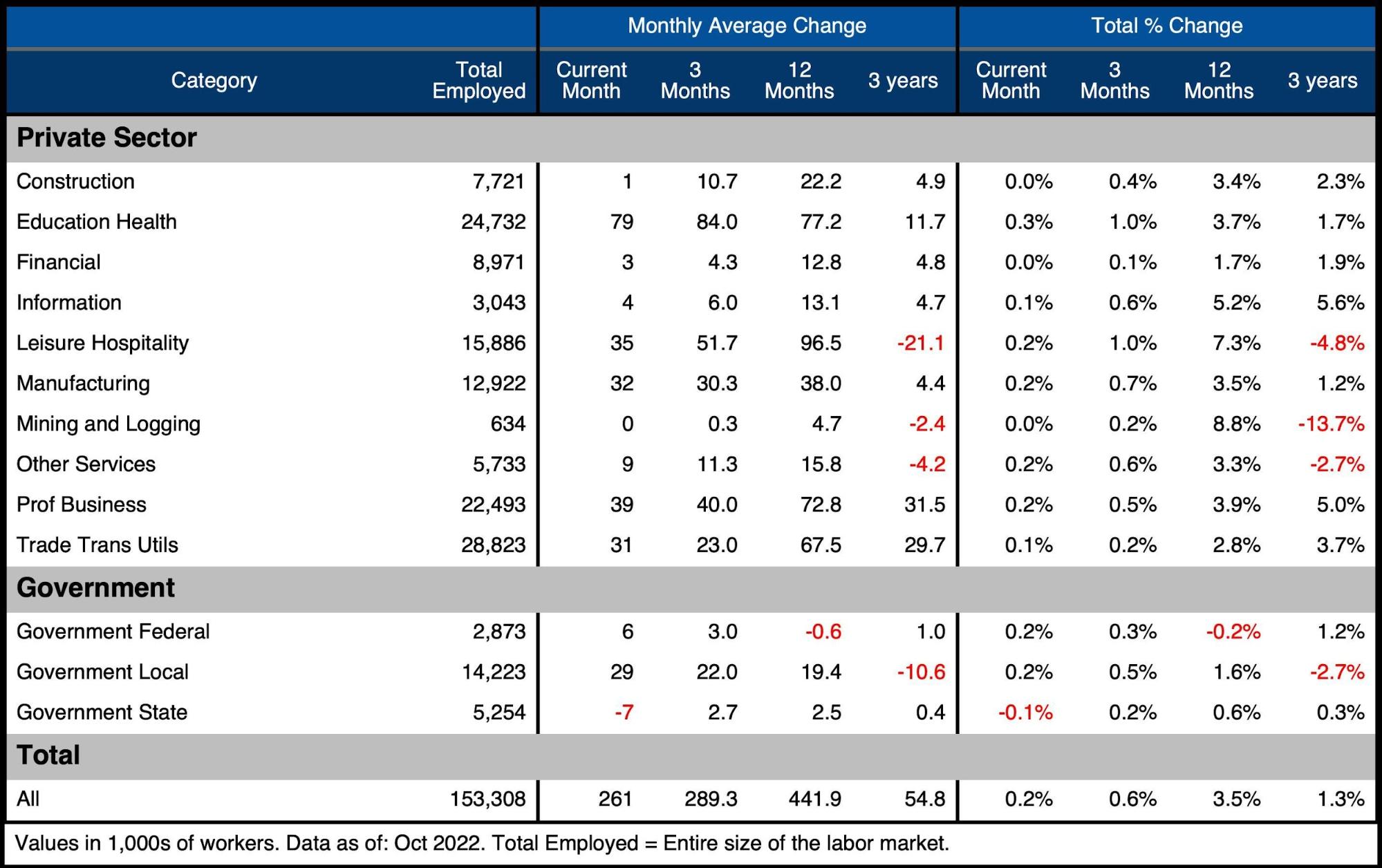

The table below shows a detailed breakdown of the numbers. The aggregate 12-month average is 441k, which is well above the most recent month of 261k.

Key takeaways:

-

- Excluding government, all but two categories (Manufacturing and Trade Transport and Utils) were even below the 3-month average

-

- The aggregate 3-month average is 289k, 28k above the current month

-

- The collapse in Construction is most likely a result of mortgage rates topping 7%, reaching the highest level since 2001

- Over the past 12 months, every category is up except for the Federal Government

- Excluding government, all but two categories (Manufacturing and Trade Transport and Utils) were even below the 3-month average

Figure: 5 Labor Market Detail

Revisions

While the headline number gets all the attention, the number is typically revised several times. Revisions over the last three months were net positive for the first time in 6 months. However, this can be entirely attributed to government jobs.

Over the last three months, revisions have increased by an average of 12,700. Government revisions have been 35k on average which means the remainder of the market has actually seen a downward revision of -22,300 jobs per month. The job market is weaker than initial reports suggest.