by Wolf Richter, Wolf Street:

“The prospect of substantial home-price declines puts them at risk of losing money.”

“The prospect of substantial home-price declines puts them at risk of losing money.”

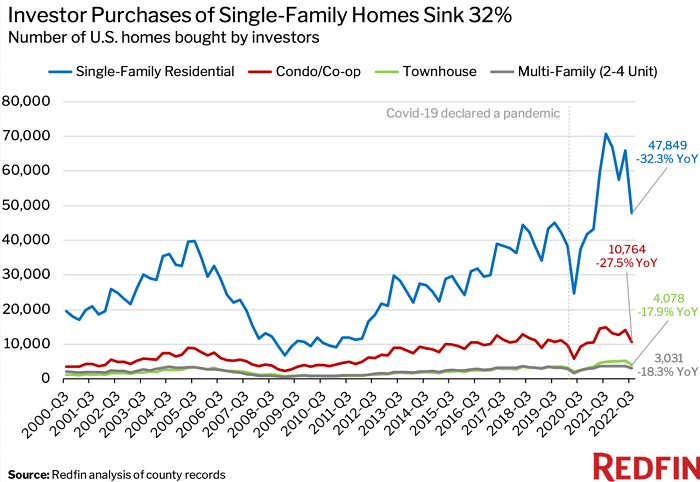

Investor purchases of single-family houses plunged by 32.3% in Q3 compared to the same period last year, according to Redfin, based on county records in the 40 most populous metropolitan areas. Beyond the lockdown Q2 2020, this was the steepest percentage plunge since the Housing Bust.

TRUTH LIVES on at https://sgtreport.tv/

Investor purchases of condos and co-ops plunged by 27.5%; of townhouses by 17.9%, and of multifamily buildings with 2-4 units by 18.3%.

The chart shows the count of homes purchased by category of homes; and on the right, the year-over-year percentage plunge. These “investors” are defined as institutions or businesses that buy residential properties. (chart via Redfin):

The increase in investor purchases in recent years also shows the impact of a major shift: build to rent, where homebuilders build entire subdivisions specifically as rental houses, fill them with tenants, and then sell the whole development to a big fund manager. Build to rent was the hottest development in the housing market before the downturn.

“Real estate investors are retreating because the prospect of substantial home-price declines puts them at risk of losing money,” said Redfin in the report, echoing what the largest buyers of single-family houses – American Homes 4 Rent, Invitation Homes, and others – have said in their earnings calls.

For example, American Homes 4 Rent, which in recent years has focused on buying build-to-rent developments, said that it had cut its purchases by 80% year-over-year to “allow the market time to recalibrate and stabilize” because home prices have yet to come down enough. “We’re starting to see some price discovery happening. But we’re still early in that process.” It said that these homebuilders still want prices that “you would have seen in March.”

According to Redfin, “It’s unlikely that investors will return to the market in a big way anytime soon. Home prices would need to fall significantly for that to happen.”

“Investors Purchases Plummet in Pandemic Boomtowns”: Redfin.

Some of the metros that investors had piled into with particular devotion are now seeing the steepest plunge in investor purchases.

“Investors expanded in these areas during the pandemic to cash in on soaring rental prices and home values, and are now pulling back as these markets slow down relatively quickly”:

| Metros With Largest % Drops in Investor Purchases: Q3 2022 | |

| % YoY | |

| Phoenix, AZ | -49.4% |

| Portland, OR | -47.4% |

| Las Vegas, NV | -44.8% |

| Sacramento, CA | -43.2% |

| Atlanta, GA | -42.2% |

| Charlotte, NC | -41.7% |

| Miami, FL | -37.7% |

| Denver, CO | -36.4% |

| San Diego, CA | -34.5% |

| Riverside, CA | -33.8% |

Investor purchases increased year-over-year in only five of the 40 metros that Redfin analyzed: Philadelphia (+46%), New York (+11%), Baltimore (+8%), Cleveland (+5%), and Newark (less than 1%).

Investor share of total purchases in Q3.

In those 40 metros combined, investors purchased 65,000 homes of all types, accounting for a share of 17.5% of all home purchases, down from a share of 19.5% in Q2 and from 18.2% a year ago, as overall purchases have plunged, and investor purchases have plunged a faster than individual purchases.

This trend was also outlined by the National Association of Realtors through October, with nationwide existing home sales plunging 28% year-over-year, and the investors’ share of those plunging sales dropping further.

According to Redfin, investors had the highest market share in these markets:

- Jacksonville, FL (share of 29.6%);

- Miami (28.9%)

- Atlanta (27.6%)

- Las Vegas (26.9%)

- Orlando, FL (26%).

In terms of Jacksonville, despite the large share of investor purchases, overall purchases plunged, and investors purchases plunged with them, by 31.9% year-over-year! “Many investors are looking to offload properties,” according to a local Redfin agent, Heather Kruayai: “Almost all of my listings right now are people looking to sell investment properties or second homes. They want to get rid of them now while they still have some value because they’re scared there’s going to be another big crash.”

Investors had the lowest market share in these markets:

- Montgomery County, PA (7.1%)

- Providence, RI (7.3%)

- Warren, MI (7.7%)

- Washington, D.C. (8.6%)

- New Brunswick, NJ (9.7%).

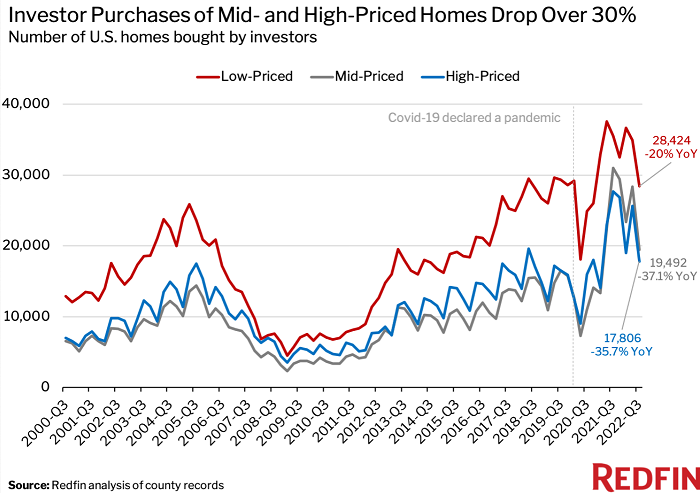

Investor purchases plunged across the price spectrum.

Year-over-year percentage decline of investor purchases by price category (chart via Redfin):

- High-priced homes (-35.7%)

- Mid-priced homes (-37.1%)

- Low-priced homes (-20.0%)

“Investors” in the housing market fall into different categories.

There are the big money managers, such as BlackRock and Blackstone and pension funds that buy entire built-to-rent developments from home builders or entire companies that are already huge landlords. The rental REITs, such as American Homes 4 Rent and Invitation Homes, also buy entire build-to-rent developments. These companies aren’t competing with individual home buyers; they’re buying established rental properties.

Then there are smaller investors buying homes as rental properties, and they’re competing with individual home buyers. But they’re facing high mortgage rates and declining home prices that make this a tough call.