by Peter Schiff, Schiff Gold:

With real wages decreasing and inflation running rampant, Americans are burying themselves in debt to make ends meet.

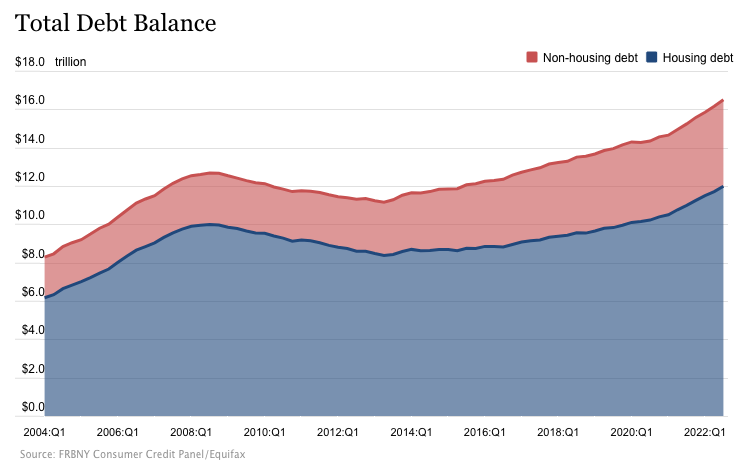

After setting a new record in the second quarter, household debt increased at the fastest pace in 15 years during Q3, as American consumers have run up credit card balances month after month this year as they cope with higher prices. Meanwhile, rising interest rates have ballooned mortgage balances.

TRUTH LIVES on at https://sgtreport.tv/

According to the latest data from the New York Federal Reserve Bank, total household debt increased by $351 billion during the third quarter. It was the biggest nominal quarterly increase in household debt since 2007.

Americans are now buried under a record $16.51 trillion in debt.

Total household debt rose 2.2% from the second quarter and is up 8.3% year-on-year.

Mortgage debt increased by $282 billion during the third quarter and stood at $11.67 trillion at the end of September. Mortgage balances have increased by $1 trillion over the last year.

Americans appear to be tapping into their home equity to help make ends meet. According to the New York Fed, balances on home equity lines of credit (HELOC) increased by $3 billion in Q3. It was the second consecutive quarterly increase after years of declining balances.

Non-mortgage debt increased by $66 billion during the last quarter.

It’s pretty clear that with stimulus money long gone, Americans have turned to plastic in order to plug holes in their budgets as prices continue to skyrocket. Credit card balances surged by 15% year-on-year in Q3, increasing by $38 billion between July and September. That was the biggest annual increase in credit card debt in more than two decades.

Meanwhile, average credit card interest rates have eclipsed the record high of 17.87% set in April 2019. The average annual percentage rates (APR) currently stand at 18.77%. That’s up from 18.45% just a month ago. That means minimum payments are increasing, and it will cost consumers more to pay off those balances.

Auto loan balances increased by $22 billion in Q3, according to New York Fed data. That continued the upward trajectory that started in 2011.

Other debt, including retail credit cards and other consumer loans, increased by $21 billion.

The only debt category that didn’t increase significantly was student loan balances. They dropped slightly to $1.57 trillion. This was a function of discharged debt due to Closed School Discharge and Public Service Loan Forgiveness. You can read more about the student loan bubble HERE.

As debt increases, more and more people are struggling to keep up with payments. According to the New York Fed, “The share of current debt transitioning into delinquency increased for nearly all debt types, following two years of historically low delinquency transitions.”

The mainstream generally spins increasing household debt as good news. You’ll hear phrases like “robust demand” and “consumers continue to spend despite rising prices signaling economic health.” But an economy built on borrowing and spending has a limited shelf-life.

Rapidly rising levels of consumer debt undercut Federal Reserve Chairman Jerome Powell’s claim that “households are in very strong financial shape.” It signals that Americans are struggling to make ends meet as prices rapidly rise, and they’re burying themselves in debt to keep their heads above water. The stimulus checks are long gone. Savings are being depleted. The average person has no choice but to pull out the plastic.