by Jim Rickards, The Daily Reckoning:

It’s time today to move on from politics and the midterm elections. This story is potentially bigger…

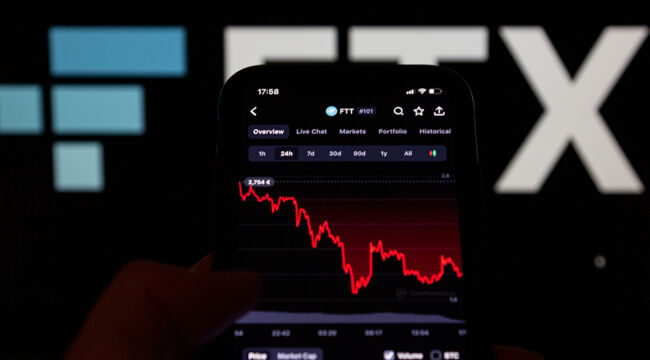

The collapse of crypto exchange FTX is the biggest economic and financial story in the world today.

Crypto may be arcane to most readers and is not well understood even by those who follow it closely. Still, it would be a mistake to think of this story as a niche development in a niche market.

TRUTH LIVES on at https://sgtreport.tv/

The FTX collapse has the potential to spin out of control and affect all capital markets in the same manner as the Mexican collapse in 1994, the Russia-LTCM collapse in 1998 and the Lehman Bros. bankruptcy in 2008.

Think that’s an exaggeration? It’s not.

The story is moving so quickly that readers would be well advised to keep up using the free crypto news service called CoinDesk, which I find quite reliable. Anyway, here’s the rundown…

The Big Brain Behind the Fraud

FTX was founded by Sam Bankman-Fried, a 30-year-old MIT graduate working with a relatively small team of fellow MIT grads and developers.

He attracted investment from some of the biggest names in the investment world including Sequoia Partners, the Ontario Teachers’ Pension Plan, SoftBank and the Singapore sovereign wealth fund Temasek.

FTX even got some investment from Tom Brady!

Bankman-Fried became one of the richest people in the world, worth over $25 billion. He donated over $40 million to Democrats in the recent midterm elections and raised millions more to support the corrupt oligarchs in Ukraine.

The Ponzi Scheme Takes Shape

FTX had an affiliate trading firm called Alameda. Like most exchanges, FTX held customer funds in separate accounts to protect customers. It now appears that Bankman-Fried’s team looted the customer accounts to support losses in the Alameda trading firm.

Word got out, and a classic run on the bank started. FTX first put up gates to stop withdrawals. Then management quit, the exchange closed and Alameda went into bankruptcy. The entire empire collapsed.

Over $10 billion in customer funds have disappeared. The remaining $1 billion in funds was hacked and stolen in what some believe was an inside job by the members of the FTX team who knew the computer code.

A criminal investigation has started in the Bahamas where FTX was registered. If that were the end of the story, it might just be an interesting (if costly) fiasco that someone will write a book about. It’s not the end of the story.

The Dominoes Start Falling

One by one, exchanges that did business with FTX are reporting losses and shutting down. Huge losses are spreading throughout the crypto industry and are beginning to leak into mainstream firms.

Meanwhile, popular meme and Gen X broker Robinhood is reported to be in difficulty and is seeing its stock price crash.

If there’s one thing we know about a financial collapse, it’s that it’s never contained to the original victims but spreads like a virus to unexpected places. It’s impossible to know how far the FTX contagion will spread. We can say with certainty that it will not be contained to crypto-world.

Read More @ DailyReckoning.com