by Rhoda Wilson, Expose News:

At an International Monetary Fund (“IMF”) seminar last month, IMF’s Deputy Managing Director and former deputy governor of the People’s Bank of China, Bo Li, spoke about the “programmability” of central bank digital currencies (“CBDCs”):

“CBDC can improve financial inclusion [ ] through what we call programmability. That is CBDC can allow government agencies and private sector players to program, to create smart contract, to allow targeted policy functions. For example, welfare payment, for example, consumption coupon, for example, food stamp. By programming CBDC, those money can be precisely targeted for what kind of people can own and what kind of use this money can be utilised, for example, for food.”

TRUTH LIVES on at https://sgtreport.tv/

GingerJim tweeted an interview from a couple of years ago with someone who explained the impact a pilot program being tested in Shenzhen, China, had on people’s daily lives.

A first hand account of how the digital ID / Social Credit Score / CBDC operates in the same city as the protests I posted about earlier. This is no fantasy! This IS coming to fruition. Listen and think about how this will change your life forever. Your freedom will be gone! pic.twitter.com/IaXIiTCCLi

— GingerJim (@GingerJim5) November 28, 2022

n the video below, Russell Brand also issued warnings as he provided a commentary on installed UK Prime Minister Rishi Sunak’s infamous speech last year and IMF’s Li’s comments on CBDCs.

Status of CBDCs Worldwide

In May 2020, 35 countries were considering a CBDC according to the Atlantic Council CBDC Tracker.

In November 2021, Visual Capitalist summarised the status of CBDCs using data from the Atlantic Council CBDC Tracker. Although widespread adoption of CBDCs is still far away, Visual Capitalist wrote, research and experiments are making notable strides forward:

- 81 countries representing 90% of global GDP are exploring CBDCs.

- The share of central banks actively engaging in CBDC work grew to 86% in the last 4 years.

- 60% of central banks are conducting experiments on CBDCs (up from 42% in 2019) and 14% are moving forward to development and pilot arrangement.

- The Bahamas is one of five countries currently working with a CBDC – the Bahamian Sand Dollar.

- Sweden and Uruguay have shown interest in a digital currency. Sweden began testing an “e-krona” in 2020, and Uruguay announced tests to issue digital Uruguayan pesos as far back as 2017.

- The People’s Bank of China has been running CBDC tests since April 2020. In all, tens of thousands of citizens have participated, spending 2 billion yuan, and the country is poised to be the first to fully launch a CBDC.

The UK central bank was less optimistic about rolling out a CBDC in the near future, Visual Capitalist noted last year. “The proposed digital currency – dubbed “Britcoin” – is unlikely to arrive until at least 2025.”

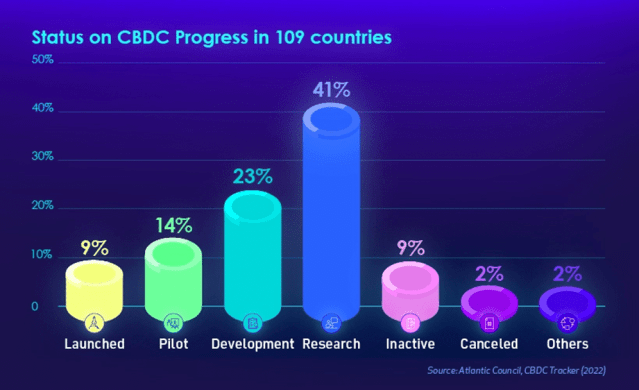

In August 2022, Visual Capitalist updated the status of CBDC worldwide, again using data from the Atlantic Council. It was then as it is now, 105 out of 109 countries being tracked are exploring CBDCs. These 105 countries represent over 95% of global GDP.

Based on this data, Visual Capitalist produced a table listing each country and summarised the data in graphics. “When aggregated, we can see that the majority of countries are in the research stage,” they wrote.

As can be seen above, 9% of countries have launched a digital currency to date. The 9% is 11 countries. You can see which 11 countries these are in the table in Visual Capitalist’s article. One of them is Nigeria.

This includes Nigeria, which became the first African country to do so in October 2021. Half of the country’s 200 million population is believed to have no access to bank accounts.

Adoption of the eNaira (the digital version of the naira) has so far been relatively sluggish. The eNaira app has accumulated 700,000 downloads as of April 2022. That’s equal to 0.35% of the population, though not all of the downloads are users in Nigeria.

Conversely, 33.4 million Nigerians were reported to be trading or owning crypto assets, despite the Central Bank of Nigeria’s attempts to restrict usage.

Visualised: The State of Central Bank Digital Currencies, Visual Capitalist

The main graphic in Visual Capital’s article is a world map showing the status by country which is too large to include here. However, further down the page the world map is divided by region, see below.