by Vance Ginn, Activist Post:

The Fraser Institute recently released the 2022 Economic Freedom of the World (EFW) Report, reflecting data and rankings for 2020. The findings show that economic freedom in the U.S. fell to its lowest level since 1975, from 6th place to 7th. Although all countries in the report were negatively affected in terms of economic freedom by the COVID-19 pandemic and subsequent shutdowns, the U.S. decline is considerable and indicative of pressing problems that will continue to erode our liberty and prosperity if left unresolved.

TRUTH LIVES on at https://sgtreport.tv/

Thankfully, the problems that put us here also point to the solutions that can propel us forward into prosperity.

- Aggressive Shutdowns

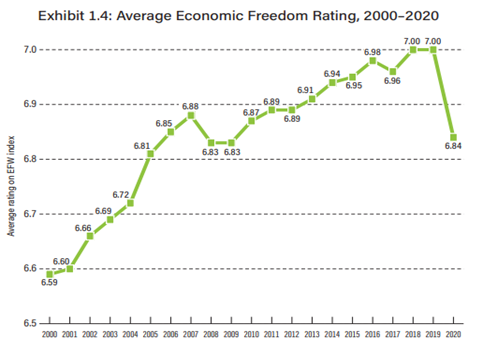

During the peak of the pandemic-related shutdowns, the EFW rating fell to its lowest level since 2009, from the depths of the Great Recession.

Entrepreneurs were sidelined, small businesses deemed “non-essential,” and many Americans sent home from work, reducing economic freedom and opportunities to quickly overcome the government-imposed dire situation.

I recently interviewed Dr. Robert Lawson, founding co-author of the EFW report and Clinical Professor at Southern Methodist University’s Bridwell Institute, about these findings.

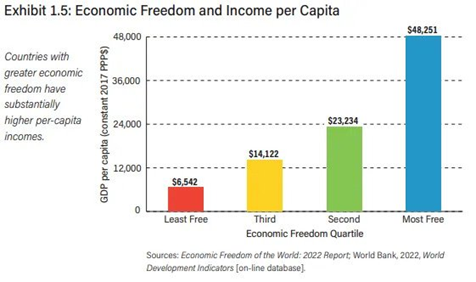

“The income per capita in the top countries [in the report] is about eight to nine times higher than the lowest-ranking nations,” he explained.

Economic freedom does not significantly affect equality, a common concern among critics, but it does have empirically positive outcomes for prosperity. As Thomas Sowell famously said, “There are no solutions. There are only trade-offs.”

In this case, the temporary health concerns of the public were placed on a pedestal that did not consider long-term prosperity. While vaccines and reopenings may have provided some relief from the pandemic, the massive economic consequences are proving to be much longer and steeper than it seems many policymakers were willing to concede.

- Out-of-Control Government Spending

In just five months, we’ll be three years out from shutdowns and stay-at-home mandates that continue to negatively affect our economy today. The national deficit of 2020 was more than three times what it was in 2019, which was already bloated at $1 trillion due to excessive government spending.

At the time, many were convinced this was necessary for getting us through a public health crisis, and they were discouraged from considering the financial consequences these measures could impose. Couple that with the Federal Reserve’s more than doubling its balance sheet to $9 trillion, simply printing money at this point, and the U.S. is enduring its highest inflation rate since 1982.