by Ronan Manly, BullionStar:

With many eyes across the world soon turning towards the Gulf State of Qatar as it hosts the upcoming 2022 FIFA World Cup later this year, now is a good time to look at another interesting development in the Qatari Emirate, namely the recent rapid growth of Qatar’s monetary gold reserves.

In August, the Qatar Central Bank raised a few eyebrows when it announced that during July, the Bank had purchased about 14.8 tonnes of gold, thereby bringing the country’s official gold reserves to 72.3 tonnes.

TRUTH LIVES on at https://sgtreport.tv/

This addition to Qatar’s gold holdings was significant because it was both the largest ever single monthly purchase of gold by Qatar’s central bank (or its predecessors), and it also raised Qatar’s monetary gold reserves to their highest level ever. In September, the Qatari’s continued their gold buying, raising their gold reserve holdings to 77 tonnes (see below).

Note that while the Qatar Central Bank (QCB) was founded in 1993, it was preceded by the Qatar Monetary Agency (QMA) from 1973 to 1993 (which preformed the functions of a central bank), and the QMA was also preceded by the Qatar-Dubai Currency Board from 1966 until 1973. Therefore records of the Bank (and its annual reports actually began in 1966).

The Central Bank of Qatar added 14.8t of #gold to its official reserves in July 2022 – appears to be the largest monthly increase on record (back to 1967), although early data is patchy. Gold reserves now stand at 72.3t, the highest on record. [Data via IMF IFS] pic.twitter.com/2xnMFAsmcH

— Krishan Gopaul (@KrishanGopaul) August 23, 2022

In a similar manner to the secretive Qatari sovereign wealth fund known as the “Qatar Investment Authority“, Qatar’s central bank is also very secretive concerning details of the central bank’s gold holdings.

Running the Data – June and July

The only two places where changes to the gold holdings of the Qatar Central Bank (QCB) can be seen are in monthly data which the QCB transmits to the IMF’s International Financial Statistics (IFS) database (here), and also in the monthly ‘Official Reserves’ reports on the QCB’s website here.

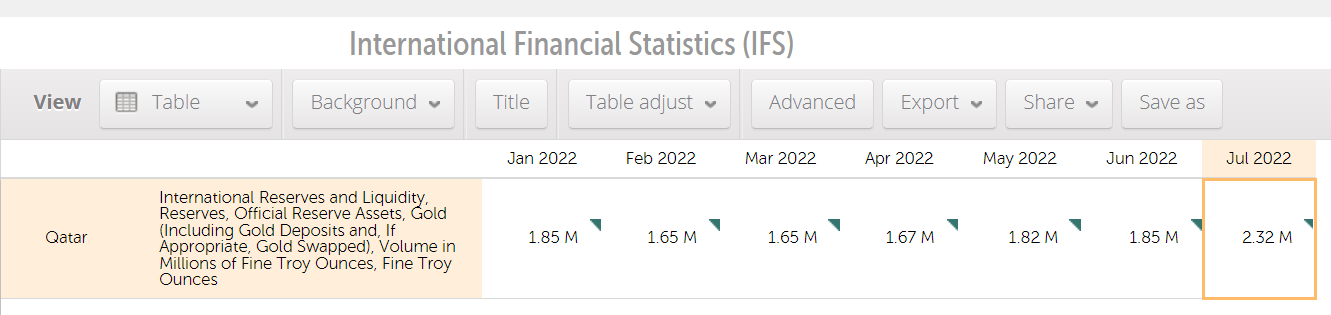

For July, the IMF IFS central banks’ gold holdings data (which is only to two decimal places) says that Qatar’s gold reserves increased to 2.32 million ozs (72.16 tonnes) from 1.85 million ozs (57.54 tonnes) at the end of June. That would be a 0.47 million ounce increase over the month of July, which is equivalent to an increase of 14.62 tonnes.

Looking at the Qatar Central Bank’s Official Reserves pages for July, the only data provided is the total value of the Bank’s gold reserves specified in Qatar’s currency, the riyal, which says that at the end of July, the Bank’s gold reserves had a total value of Qatari riyals (QR) 14.9409 billion.

Given that the Qatari riyal has a rigged fixed exchange rate to the US dollar of QR 3.64 per USD (yes, that’s the official Qatari exchange rate policy), then this means that at the end of July, the value of Qatar’s gold reserves in US dollars was US$ 4.1046 billion.

If you assumed that the QCB calculates a month-end value for its gold using an international gold price such as the LBMA afternoon gold fixing on the last business day of the month, and given that the LBMA PM fix for gold on Friday 29 July was US$ 1753.4 per troy oz), then the US$ 4.1046 billion value would suggest that Qatar held 2,340,962 ozs of gold at the end of July (or 72.81 tonnes). Which is slightly more gold than they claimed to have based on the IMF IFS data.

But if you use the gold price on the actual last day of July, which was Sunday 31 July when the gold price pre-COMEX opening was US$ 1766.2, you get a figure of 2,323,997 ozs or 72.28 tonnes. So it looks like the QCB uses a valuation point of the last day of the month, not the last international business day. And anyway, a Sunday in Qatar is a business day.

Applying the same logic to the end of June (where 30 June was a Friday and the LBMA PM gold fixing was US$ 1817), yields the following. At the end of June, the QCB in its Official Reserves report claimed to hold gold worth QR 12.236 billion. This translates to US$ 3.36159 billion, which at a price of US$ 1817 per oz implies that Qatar held 1,850,079 ozs of gold, or 57.54 tonnes at the end of June. This is also the exact same gold holding (i.e. 1.85 million ozs) as in the IMF IFS data. Which also means that during July, the QCB bought 14.74 tonnes of gold.

Running the Data – August

The reason for explaining all of this is that it also now looks like the Qatar Central Bank purchased even more gold during August. This is because while the QCB has not yet sent any August gold holdings data to the IMF IFS database, the Qatar Central Bank has already gone and independently published its official reserve data for the end of August on its website.

And the QCB Official Reserves report for August (link here) shows the following.

As of the end of August, the QCB held gold worth QR 15,465.2 billion. This translates to US$ 4.24868 billion. Given that 31 August was a Wednesday, we can use the LBMA PM gold fixing price on that date, which was US$ 1715.9 per oz. This implies that on the last day of August, the QCB held 2,476,066 ozs of gold, or 77.01 tonnes. And given the fact that the QCB held 72.28 tonnes of gold at the end of July, this also means that during August, the Qataris bought another 4.73 of gold for Qatar’s monetary gold reserves.