by Peter Schiff, Schiff Gold:

Gold is nature’s money.

Aristotle listed four characteristics of sound money: it must be durable, portable, divisible, and have intrinsic value. Gold possesses all of these characteristics, which is why gold has served as money for thousands of years.

As Goldmoney founder Jame Kirk put it in an article published by the Mises Wire:

TRUTH LIVES on at https://sgtreport.tv/

Every natural element with which the earth has been endowed has a usefulness—a purpose. If we listen to gold, its message is loud and clear—gold is money. To serve as natural money is gold’s highest purpose.”

Modern financial systems spurn gold. Governments prefer fiat money that they can easily manipulate for their own purposes. Primarily, they need the ability to create more money without limits in order to feed their appetite for spending.

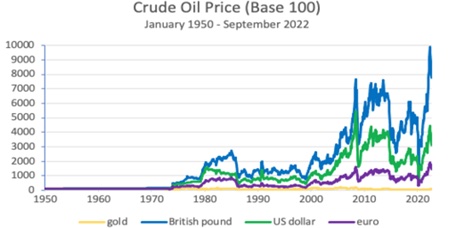

Nevertheless, nature’s money is still superior. Consider this: an ounce of gold buys the same amount of oil as it did 70 years ago.

Pricing other commodities in gold over time yields the same results. And if you price many consumer goods in gold, you’ll often see depreciation. Prices tend to fall over time as technology and innovation increase productivity. Inflated fiat currency obscures these productivity gains.

Kirk sums it up this way.

Gold preserves purchasing power, which is one of the key requisites of money. As illustrated by the above chart, it is an outcome that no national currency can match.”

Sound money also enables sound economic calculation. As Kirk explains, this is only possible “using a consistent, unchanging unit of account to measure prices over time.”

Gold serves this role perfectly because it is the only element in the known universe that is eternal and not subject to decay or degradation. A gram of gold today is identical to a gram of gold mined by the Romans.”

One important characteristic of sound money is that its stock remains relatively constant. The amount of mined gold has grown over the years, but it has expanded at a relatively consistent rate. According to Kirk, the average annual rate over the last 529 years is 1.2%. Since 1960 the average growth in the gold stock is 1.8%, ranging from 1.4% to 2.2%.

Compare that to the stock of dollars. Since 1960, money supply growth varied from a low of 1% in 1993 to a high of 19.1% in 2020. As a result, “this inconsistency results in swings in the dollar stock that in turn causes volatility in prices expressed in dollars because there are not enough or too many dollars circulating relative to the prevailing level of economic activity.”

Economist Milton Friedman developed the k-percent rule. In a nutshell, he postulated that the quantity of currency should increase by a constant percentage rate every year, irrespective of bank credit cycles. As Kirk explains, gold comes closer than any central bank-managed currency to fulfilling this rule.

The gold stock grows at approximately the same rate as world population and new wealth creation. Consequently, the purchasing power arising from the interaction of gold’s supply—its aboveground stock—and the unfailing inelastic demand for gold that exists because it is money, make gold uniquely useful to accurately calculate the price of goods and services throughout time. It is a feature that the dollar and other national currencies fail to match because their annual growth rates are not consistent, causing fluctuations in their “aboveground” stock. Since 1950 the weight of the gold stock has grown 3.5 times, but a gram of gold still purchases the same amount of crude oil.”

Significantly, gold doesn’t require “management” by central bankers. Experience teaches us that currency management always creates artificial booms rife with malinvestments and misallocations. This inevitably leads to busts.

Recurring bank and currency crises throughout history result from human error and other human frailties that inevitably destroy fiat currency, like the unwillingness to “take away the punchbowl” after a period of prolonged credit expansion. Gold is different. Gold does not need management by a central bank or government. Gold is money that manages itself because growth in the gold stock is controlled by two immutable forces—nature and profitable mining. Together they impose discipline on the production of gold that prevents the money punchbowl from overflowing, which is a key factor explaining why gold preserves purchasing power over time.”