by Peter Schiff, Schiff Gold:

Let’s say you were a country or a group of very wealthy individuals and Covid hits. You see governments around the world print money like crazy. It makes you think there might be some inflation to deal with and you want to protect yourself. Gold and silver are the logical choices. So, if you decide to accumulate a whole bunch of precious metals, how would you do it?

You couldn’t do everything at once or it could move prices or possibly raise alarm bells that would block you from obtaining the metal you want. So, you would probably slowly start taking ownership of as much metal as possible without driving up the price. About halfway through accumulation, you would probably want to start taking physical possession of that metal. This seems like a logical and strategic plan.

TRUTH LIVES on at https://sgtreport.tv/

Well, that is EXACTLY what the data shows has happened over the last two years. The data also shows that the accumulation of silver may be complete and now it’s just about getting the metal out of the vault. Gold appears to be in the accumulation phase still, but it’s also a much bigger market. Let’s look at the data…

Gold: Recent Delivery Month

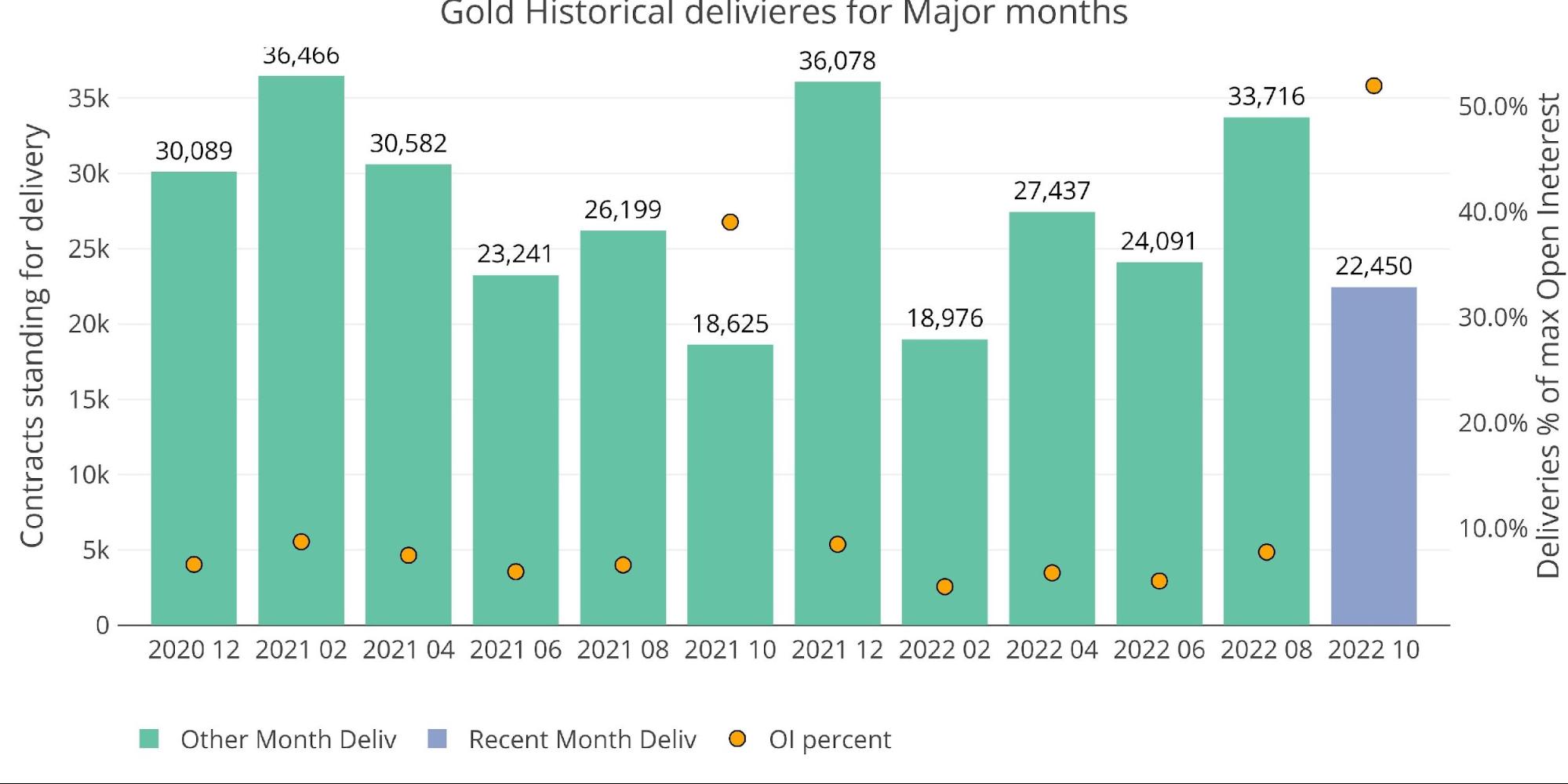

October gold saw very strong delivery for a contract that is neither major nor minor (10x bigger than minor but 1/10th the size of major). Total contracts delivered so far (22,450) is 20% larger than last October and still has about 800 contacts remaining in Open Interest.

One thing to notice is that deliveries as a % of max open interest exceeded 50%. This type of action is typically seen in minor months with major months never rising above 10%. Even last October came in below 40%.

Figure: 1 Recent like-month delivery volume

Another interesting data point is that total deliveries will likely exceed the amount of open interest seen before First Notice (orange bar vs blue bar below), which will be the first time that happened since last October.

The indication here is that a lot of contract holders were not rolling into the close as is typically seen. They stuck around and took delivery of metal.

Figure: 2 24-month delivery and first notice

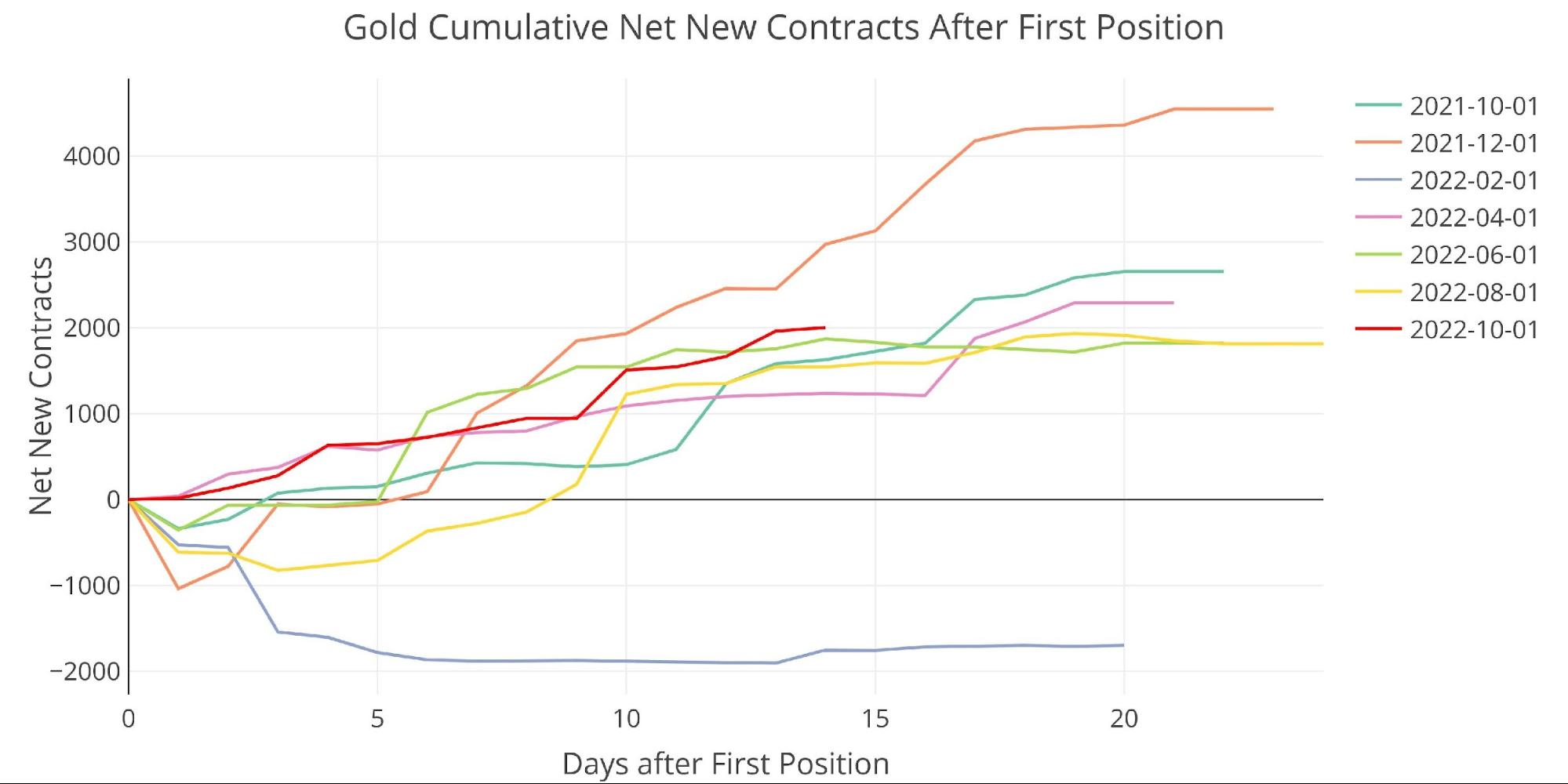

In October, mid-month activity is the strongest seen in a major(ish) month in 2022 so far. It is higher than October last year and only short of last December.

Figure: 3 Cumulative Net New Contracts

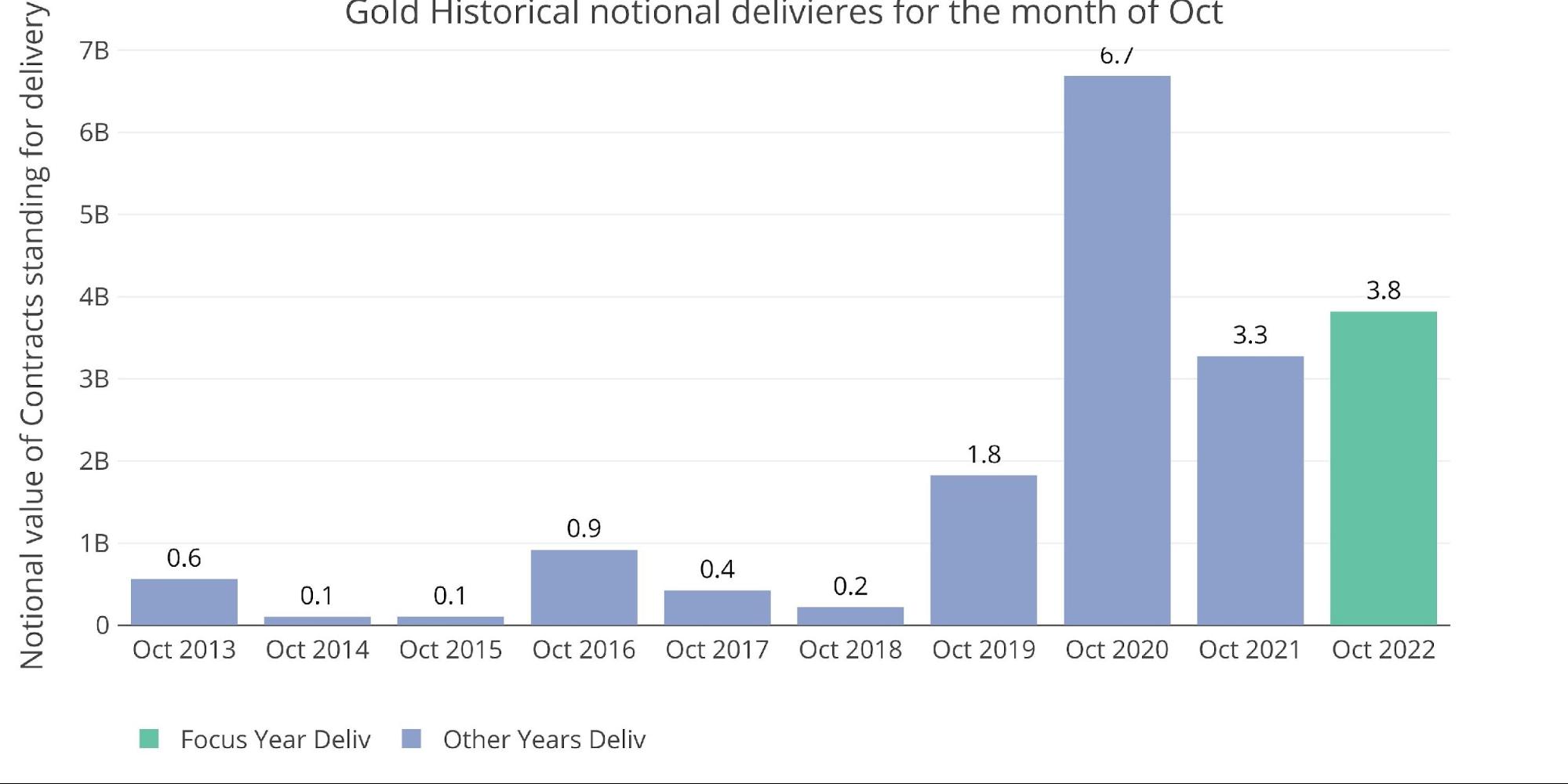

From a dollar volume perspective, this October will be the second-largest October on record!

Figure: 4 Notional Deliveries

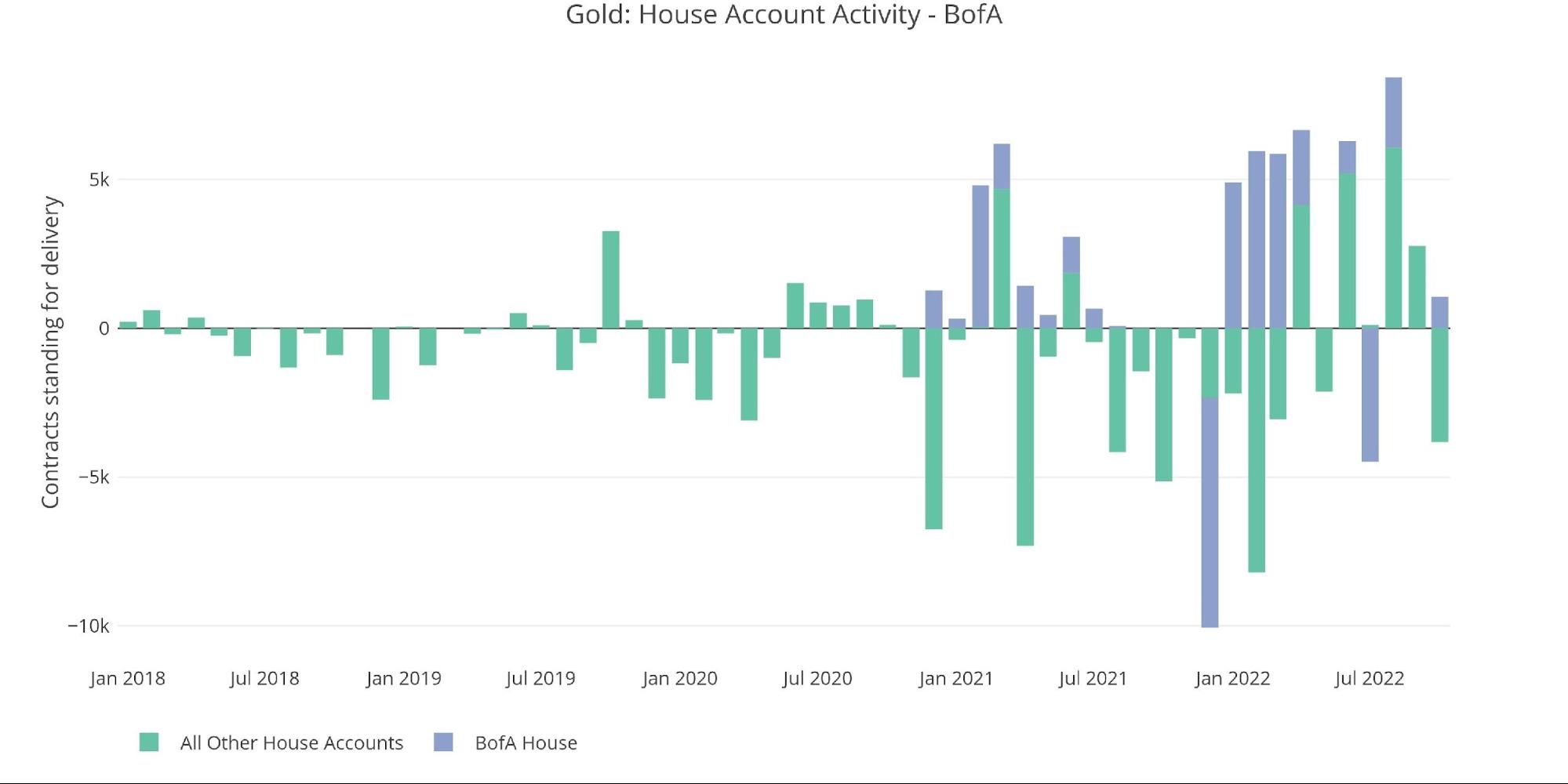

The bank house accounts (excluding BofA) have delivered 3200 contracts on Net. This is the largest amount since Feb 2022 before the Russian invasion of Ukraine.

Figure: 5 House Account Activity

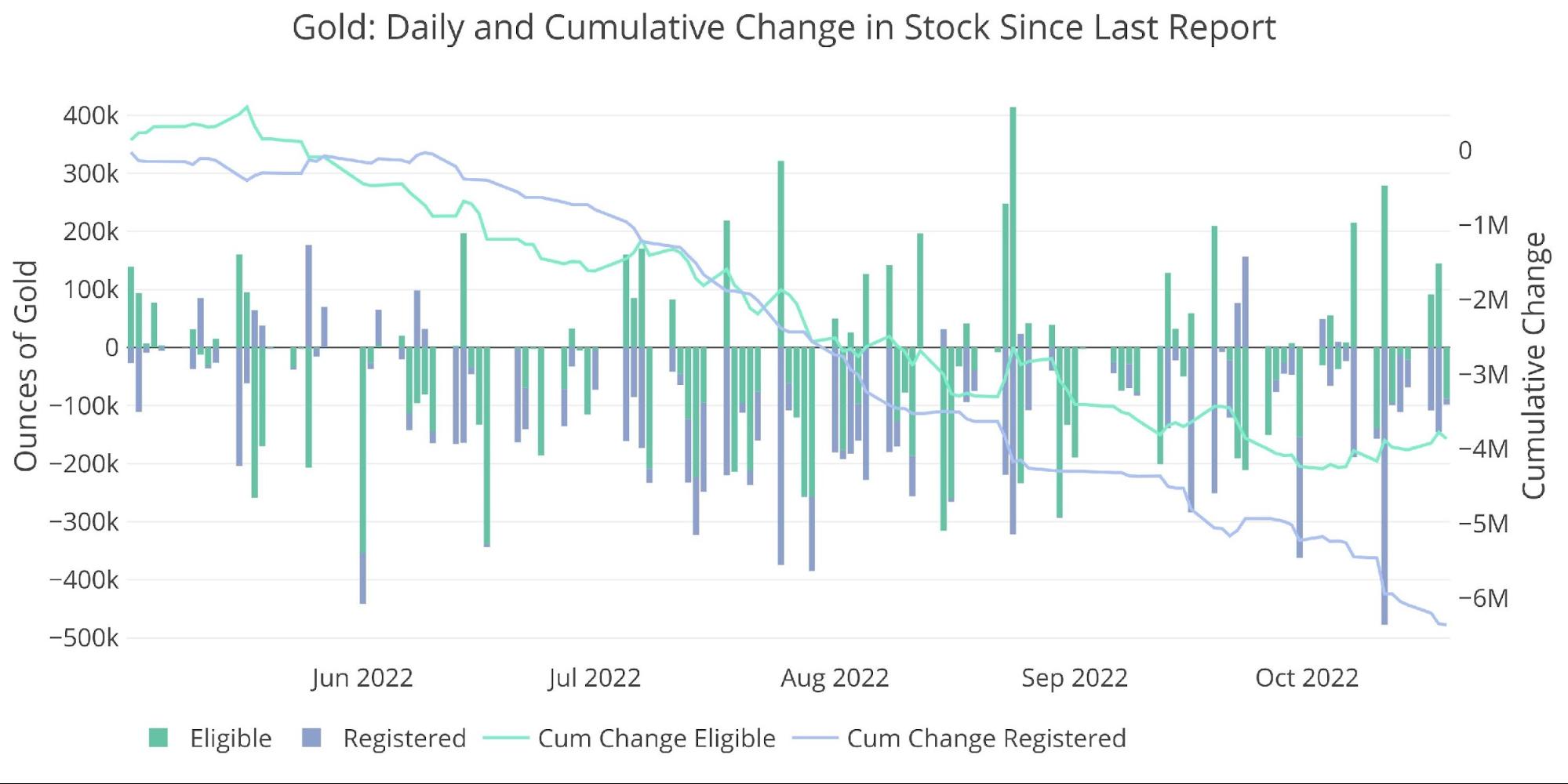

As the recent stock report showed, the physical movement continues unabated. Since May 1st, Registered gold has fallen by 6.35M ounces. The drainage has been non-stop for months now. Every day, little by little, the metal is being removed from Comex.

For perspective, in May, the total Registered stood at 18M ounces. This means that at the current pace, all Registered gold will be gone in less than a year!

Figure: 6 Recent Monthly Stock Change

Gold: Next Delivery Month

Jumping ahead to November shows a strong increase in open interest as First Position approaches.

With seven days to go, open interest is slightly below September (which became a record month) and a bit below March (just after the invasion). It’s likely November will be another strong delivery month given the current trajectory.