by Wolf Richter, Wolf Street:

But Kia, Toyota, Honda: nearly nothing on the lot. Where the shortages are, and where ample supply is, by brand and segment.

But Kia, Toyota, Honda: nearly nothing on the lot. Where the shortages are, and where ample supply is, by brand and segment.

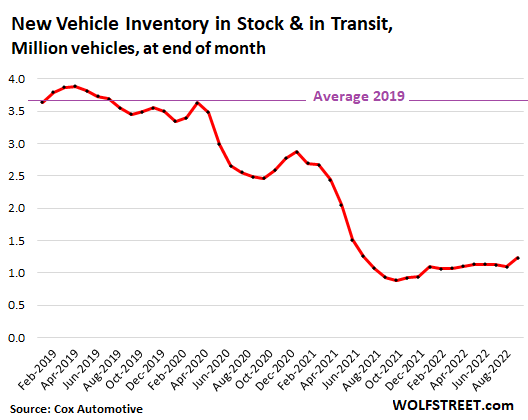

At the end of August, inventories of new vehicles on dealer lots and in transit ticked up to 1.23 million vehicles, still at the woefully low levels that have prevailed since the spring of 2021, down by 65% from August 2019.

TRUTH LIVES on at https://sgtreport.tv/

But increasingly, there is now a new wrinkle in these shortages, according to inventory data from Cox Automotive: Many fuel-efficient models have essentially vanished from inventories, and there are long waiting lists for many of those models, and customers wait for months to get what they ordered, including EVs and hybrids and compact cars, while inventories of pickup trucks and other larger vehicles are building, and some brands, such as Ram and Dodge, are now overstocked and are offering massive discounts.

In terms of days’ supply at the end of August, it ticked up to 40 days, from 37 days in July. This is still very low, but up from the 30-day range last summer. By comparison, in 2019, supply averaged 89 days, and that was on the high side, and there were lots of deals to be had.

The chip shortages persist, but to a lesser extent.

Monday evening, Ford announced that it expects to have 40,000 to 45,000 unfinished vehicles on storage lots at the end of Q3, waiting for parts.

Since last year, automakers have been building vehicles that were missing components in order to keep their plants operating. When the missing components arrive, automakers install them, complete the vehicles, and ship them to dealers.

GM, at the end of Q2, had 95,000 unfinished vehicles on storage lots, waiting for components. Other automakers are also doing this to mitigate the effects of the chip shortages.

Shortages are concentrated in specialized cheap microcontrollers and semiconductors that the auto industry uses for mundane things. If one of the chips in a rear-view mirror is in short supply, the component maker cannot deliver the rear-view mirrors to the assembly plant, and the vehicle cannot be completed. But it can be built, and put on a storage lot, and when the rear-view mirror arrives, the vehicle can be completed.

Where are the shortages, and where is the ample supply?

As a result of the gasoline price spike this year, the most fuel-efficient vehicles have essentially vanished from dealer inventories. When you see “20 days’ supply,” you will find nearly nothing on the lot of many dealers, and most of the vehicles showing in “inventory” are actually in transit, and many of them have already been sold before they arrive on the lot.

The seven segments with big shortages. Seven of 23 major segments have between 20 and 30 days’ supply. This means that most of these vehicles in “inventory” are either in transit or have already been pre-sold. When customers show up to shop for one of these models, they will often be confronted with nothing to choose from, and they may have to order instead.

One of these seven segments is an outlier in terms of fuel efficiency: High-performance cars (22.2 days’ supply). But with an average price of $110,000, they’re not exactly mass-market vehicles.

These are the segments with shortages – and they’re frustrating for all involved, customers, dealers, and automakers. This data was provided by Cox Automotive.

| Overall Rank | Segments with the biggest shortages | Days’ Supply |

| 1 | Hybrid/Alternative Energy | 21.2 |

| 2 | Subcompact Car | 21.6 |

| 3 | High Performance Car | 22.2 |

| 4 | Compact Car | 25.6 |

| 5 | Minivan | 27.7 |

| 6 | Electric Vehicle | 27.9 |

| 7 | Mid-size Car | 28.4 |

The nine segments with tight to adequate inventories. In this group, you’ll find a broad range of vehicles, and including lots of SUVs and crossovers. Midsize pickup trucks are in this segment, but not full-size pickup trucks:

| Overall Rank | Segment with tight to adequate supply | Days’ Supply |

| 8 | Luxury Full-size SUV/Crossover | 30.6 |

| 9 | Compact SUV/Crossover | 34.2 |

| 10 | Mid-size Pickup Truck | 36.3 |

| 11 | Subcompact SUV/Crossover | 37.9 |

| 12 | Entry-level Luxury Car | 40.7 |

| 13 | Luxury Mid-size SUV/Crossover | 40.9 |

| 14 | Mid-size SUV/Crossover | 41.6 |

| 15 | Van | 43.0 |

| 16 | Full-size SUV/Crossover | 44.0 |

| 17 | Luxury Car | 45.2 |

| 18 | Sports Car | 45.6 |

The five segments with plenty of supply, including full-size pickup trucks. For retail buyers, full-size pickup trucks are the most popular vehicles. The best-selling models of all times are full-size pickup trucks. This is a huge and stunningly profitable segment of the auto industry – and has been for many years.