by Egon Von Greyerz, Gold Switzerland:

As the dark years are approaching, the world is now approaching survival mode. Admittedly, if you go to a high class restaurant in New York, London or Zurich, there are no signs of misery but instead of incredible affluence.

What is happening to middle America or England has not yet reached Wall Street or the City of London where exquisite food is plenty and excellent wines are flowing.

This is of course no different to the end of eras with major excesses and decadence. It was the same at the peak of the Roman Empire 2000 years ago or in 1929 just before the Dow crashed 90%.

TRUTH LIVES on at https://sgtreport.tv/

Main Street is already in survival mode with cost of living increases of a magnitude that ordinary people can’t afford. Energy, fuel, food, mortgage rates, rents and most things have gone up by 10-20% or more in the last year.

MORE ABOUT EXTREME RISK AND GLOBAL WARNING AT THE END OF THIS ARTICLE

Everything has happened so quickly that people are in shock. But it is a fact that real MISERY has now hit ordinary people.

As Charles Dickens wrote in David Copperfield:

Annual income twenty pounds,

annual expenditure nineteen six,

result happiness. Annual income

twenty pounds, annual

expenditure twenty pound

ought and six, result misery.

For Main Street it is no longer a question of making ends meet but of economic survival.

The Fed and other so called “independent” central banks are doing all they can to exacerbate the crisis. The Fed’s official two tasks are stable inflation and full employment.

Stable inflation the Fed has in latter years defined as 2%. How did they arrive at that? They probably don’t know themselves since there is nothing good about 2%. Because an annual inflation rate of 2% means that prices double every 36 years which is highly undesirable.

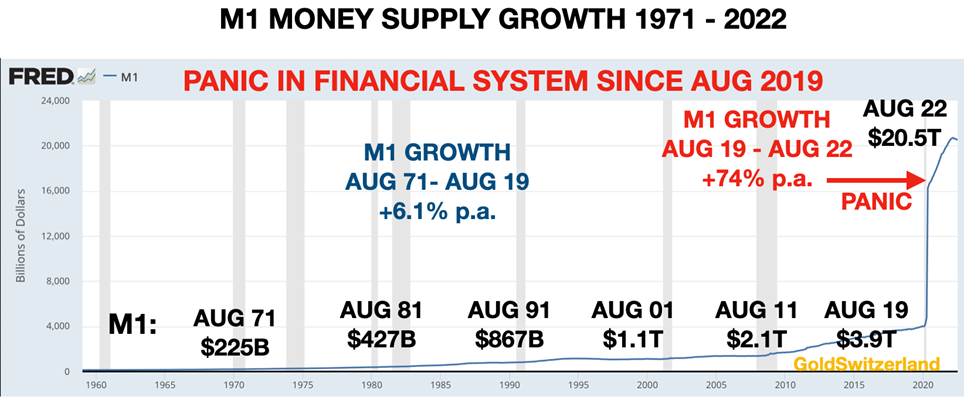

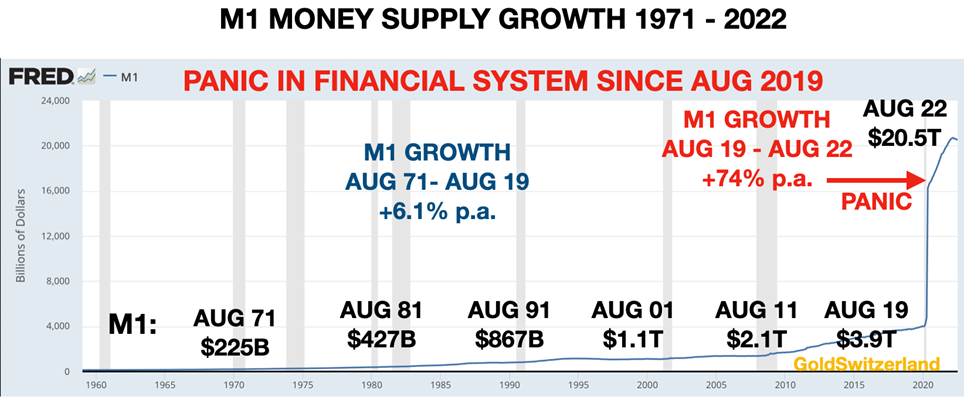

Anyway, even with pumping up M1 Money supply by $19 trillion between 2006 and December 2021 and keeping interest rates at 0% they still don’t have a clue why inflation is going up.

Many of us were laughing at Powell and Lagarde when they called the increase in inflation transitory!

Whilst clueless central bank heads are transitory, current inflation certainly isn’t.

HYPERINFLATIONARY ROCKET

It is absolutely incredible that the heads of the Fed and ECB, the world’s biggest central banks, didn’t have the basic knowledge to fathom that unlimited free money for over 10 years is like a matchstick to light the biggest inflationary rocket in history.

Yes, it seemed to take a long time before the inflation rocket was set alight. The explanation is self-evident. There were different compartments in the rocket. Before the consumer prices were set alight, the inflation flame reached all the financial assets such as stocks, bonds and property.

Between 2009 and January 2021, the Nasdaq for example went up 16X, the S&P 7X and house prices went up 2X.

But conveniently for the Fed, this Hyperinflation in asset prices doesn’t count as inflation.

So the Fed could continue to fulfil its main purpose which is to make the rich richer. As the Fed was conceived by private bankers in Jekyll Island in 1910 for the main purpose of enriching the bankers and their friends, it is clear that this Elite group must be looked after first.

ZERO INFLATION AND ZERO INTEREST RATES

In the autumn of 2021, as the inflation flame reached consumers, the Fed, ECB and other central banks were stuck in their zero inflation and zero interest rates lethargy.

But as 2022 progressed, central banks around the world woke up to the fact that inflation is here to stay. Since the wealthy probably have diversified into real assets by this stage, it was then time for the bankers to start tightening without hurting their wealthy friends.

Globally the Fed and their fellow banks, are without exception always behind the curve. So they flooded markets worldwide with worthless printed money at zero cost for much too long.

And now they are waking up to the fact that the accelerated money printing (debt creation) since 2019 is not just inflationary but hyperinflationary. So the inflation rocket is now fully ignited and has just started its journey.

Powell, Lagarde and at least 32 other central bankers in the world have gone from lethargy to panic mode and are thus coordinating a series of rate increases globally.

MONEY PRINTING TO INFINITY

Since ordinary people in the world are now suffering substantially due to massive inflation of everyday expenses, they no longer can make ends meet.

The next move we will see in many countries is the resumption of money printing or QE. In the UK, the new Chancellor Kwarteng (finance minister), decided to give major support to businesses and individuals with lower taxes and social charges, energy subsidies etc. The total cost will be in the hundreds of billions of pounds over coming years. The already weak pound fell another 5% and rates surged. The pound is now down 24% since May 2021.

So the consequences of this give-away UK budget will be higher inflation and higher cost of living for people. This is a vicious cycle that will be followed by most nations as they enter the race to perdition.

THIS TIME IS DIFFERENT!

Stock market investors have for decades been so uber-confident of their banker friends saving them from any major losses that any fall in the market is a buying opportunity.

Thus we have a whole generation of investors that have never seen a sustained bear market as they have always been saved by central banks.

But this time is different! Take my word for it. Central banks are now on a course to deflate all asset markets. As usual they will go on for longer than anyone expects.

And eventually it becomes a vicious cycle with higher rates, higher inflation, still higher rates and more inflation until both central banks and markets panic as the world enters a depressionary hyperinflation.

It might be difficult to fathom that we can have a depression and hyperinflation simultaneously. But as asset prices collapse (remember they are not measured in the inflation numbers), prices of consumer products will surge.

And that is exactly what we are seeing the beginning of now.

Stocks are down around 25% so far, bonds are down, property markets under pressure and food, energy, fuel, mortgage rates are doubling or trebling for many borrowers.

Read More @ GoldSwitzerland.com