by Egon Von Greyerz, Gold Switzerland:

We have dedicated numerous articles and interviews addressing the dangerous strength of the USD on the heels of a deliberately hawkish Fed hiking rates into what is clearly a recession, official or otherwise.

Explaining the Inexplicable: Rising Rates into a Recession?

On the surface, such central bank tightening in the face of a tanking economy and increasingly volatile risk asset markets makes little sense, as a strong USD and higher interest expense (i.e., interest rate policy) crushes just about every asset class in its wake, from an empirically broken bond market and grotesquely over-valued stock market to the artificially repressed precious metals space.

TRUTH LIVES on at https://sgtreport.tv/

So, why is the openly cornered Fed acting so openly at odds with the real world and the US economy after years of feeding it instant-liquidity at every “dip,” cough or market sniffle?

The Fake War on Inflation

The standard answer is to “fight” inflation (which the Fed’s own mouse-click money alone created).

But as we’ve also written and observed so many times, a Fed Funds Rate at 3%, 4% or even 5% is not only mathematically crippling to a nation which simply can’t afford such rates, it is equally impotent against a headline CPI print in the 8-9% range (and rising).

In short: Rate hikes won’t defeat money supply driven or supply-constraint driven inflation at all.

Thus, and again, what is the Fed really doing and thinking notwithstanding the official nonsense that makes the headlines or pours from their double-speaking lips?

A Weaponized Fed Running Out of Bullets

One answer: The Fed, like the SWIFT removals and FX reserve freezes, is just another weaponized tool against Russia and the seismic shifts (petrodollar, LBMA alternatives, mono-to-multi-currency trade agreements) resulting globally ever since the openly failed sanctions against Russia were commenced earlier this year.

To any who understand the origins, history and actual practices of the Federal Reserve, the notion that this cabal of private bankers is an “independent” entity is by now an open farce.

That is, the Fed is anything but “independent” and is not only a political fixture of the DC horizon, but rather a political hijacker of the American economy, markets and policy in ways the go far, way far, beyond its supposed “mandate” to simply manage U.S. inflation and employment.

It is my own strong belief that one of the primary motives behind the current rate policy to strengthen the USD has been to help the U.S. government break the financial back of Russia, which like all its prior policies/sanctions (based on the re-invigorated Russian currency, trade surpluses and multi-lateral trade agreements) is failing.

Toward this end, it is far more than likely that the Fed’s “weaponized” rate hiking will continue this week, much, frankly to the chagrin of a temporarily falling gold price.

What one has to ask however, is will this policy backfire as well (?), for it seems that this game of financial chicken with Putin is breaking the back of the US markets and economy (and its EU allies) with far greater effect.

Hubris Comes Before the Fall

I am once again reminded of the 2014 statement made by then U.S. Secretary of State, Condoleezza Rice, that Russia would run out of money long before the West ran out of energy.

Less than a decade after this classic example of American hubris was made, it seems Russia (as well as China, the BRICS and a string cite of emerging market economies) would beg to differ as the world shifts from a U.S.-led mono-currency system to an increasingly multi-national currency, trading and political new direction.

None of this, by the way, will be “orderly.”

Within the US markets and economy, conditions keep trending from bad to worse in every category– from risk assets, social division, and political impotence to the headline-making layoffs at Goldman Sachs, the tanking profits at FedEx and the destruction of the U.S. working class under the invisible tax of persistent rather than “transitory” inflation.

Meanwhile In Europe…

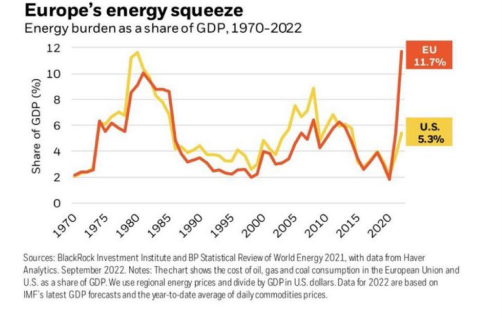

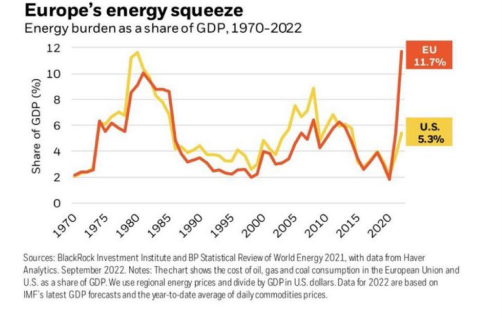

The price for blindly following the so-called “moral” lead of the US in its political and financial war against Putin (to save a less-than-moral thespian like Zelenskyy) is becoming increasingly high as the delusion that Putin has less leverage than the West becomes increasingly harder to sell, swallow or justify.

In addition to facing an extremely cold and expensive winter…

…the Europeans are seeing their currency at 20-year lows against an artificially inflated dollar.

But it’s not only Europe’s (or Japan or England’s) currency which is tanking, but their trade balances as well, which is otherwise atypical, as weakening currencies are supposed to improve rather than weaken export competitivity.

Read More @ GoldSwitzerland.com