from The Conservative Treehouse:

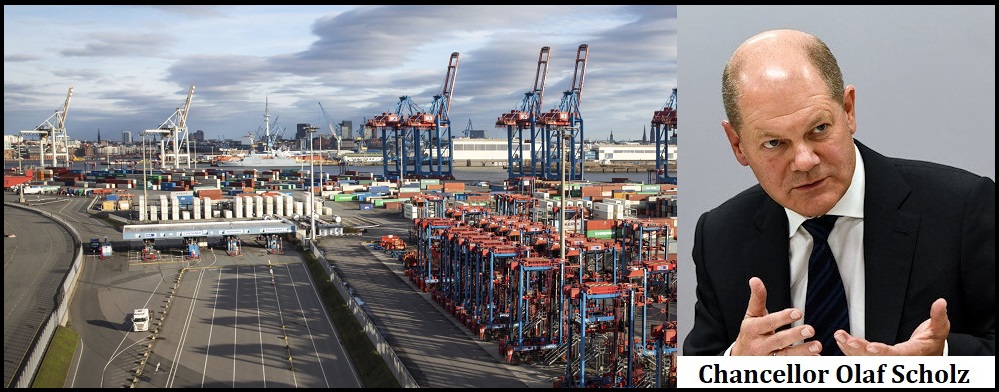

The statistics behind the energy impact upon the German economy, the largest economy in the European Union, are almost unfathomable in scale. There is no way for the German industrial economy to continue with this level of price pressure. Stick a fork in the current creation of German industrial products and exports, the inflection point of feasibility for continued production has been crossed. They are done.

TRUTH LIVES on at https://sgtreport.tv/

According to release statistics from the German economic ministry, energy prices in August were more than double the same period last year, up 139%. The monthly increase was more than 20.4% higher than July. Additionally, producer prices for electricity rose 174.9% compared with August 2021 and by 26.4% in a single month.

This jaw-dropping increase in energy cost has resulted in German manufacturing prices for industrial goods jumping 7.9% in August alone, with a year-over-year increase in the cost to manufacture goods at 45.8%. That is the highest rate of price increase since Germany began recording their statistics in 1939.

BERLIN, Sept 19 (Reuters) – German producer prices rose in August at their strongest rate since records began both in annual and monthly terms, driven mainly by soaring energy prices, raising the chances that headline inflation will surge even higher.

Producer prices of industrial products increased by 45.8% on the same month last year, the Federal Statistical Office reported on Tuesday. Compared to July 2022, prices rose 7.9%, it added.

The surge was considerably stronger than expected, with analysts having forecast a 37.1% year-on-year rise and a 1.6% monthly rise, according to a Reuters poll.

In July, the year-on-year increase had been 37.2% and in June 32.7%.

Energy prices in August on average were over double the same period last year, up 139%, and 20.4% higher than the previous month, the office reported. (read more)

Once again, my friends…. Pretending meets reality!

What does this mean in practical terms?

Firstly, it means the people within Germany and the larger EU will not be able to afford goods if the increased price to manufacture them is passed on to customers. German industrial goods, including the heavily dependent auto sector, will hit the market at double the price from last year. Exported goods, again assuming the government doesn’t provide some sort of subsidy to offset, would also double.

Secondly, it means the prices of used goods will increase in value. With imported vehicles holding that scale of increased manufacturing price, I would expect to see German automobile dealers in the U.S. sending out incentives to purchase used BMW’s, Audi’s and Mercedes for the products that are not produced in North America.

Lastly, on a global scale, Germany is dependent on selling industrial equipment to Asia and North America in the manufacturing sector. With declining demand for finished products -the result of inflation- there was already a lowered demand for machinery, machined tools and heavy equipment. Downward pressure due to a lack of demand, combined with upward price pressure to manufacture the industrial products, creates an even worse scenario.

Right now, Germany is on the cusp of a full-blown economic meltdown, and as we have seen recently German Minister of Economics Robert Habeck (pictured below) has no idea how to handle it.

Read More @ TheConservativeTreehouse.com